Gold Trade Idea

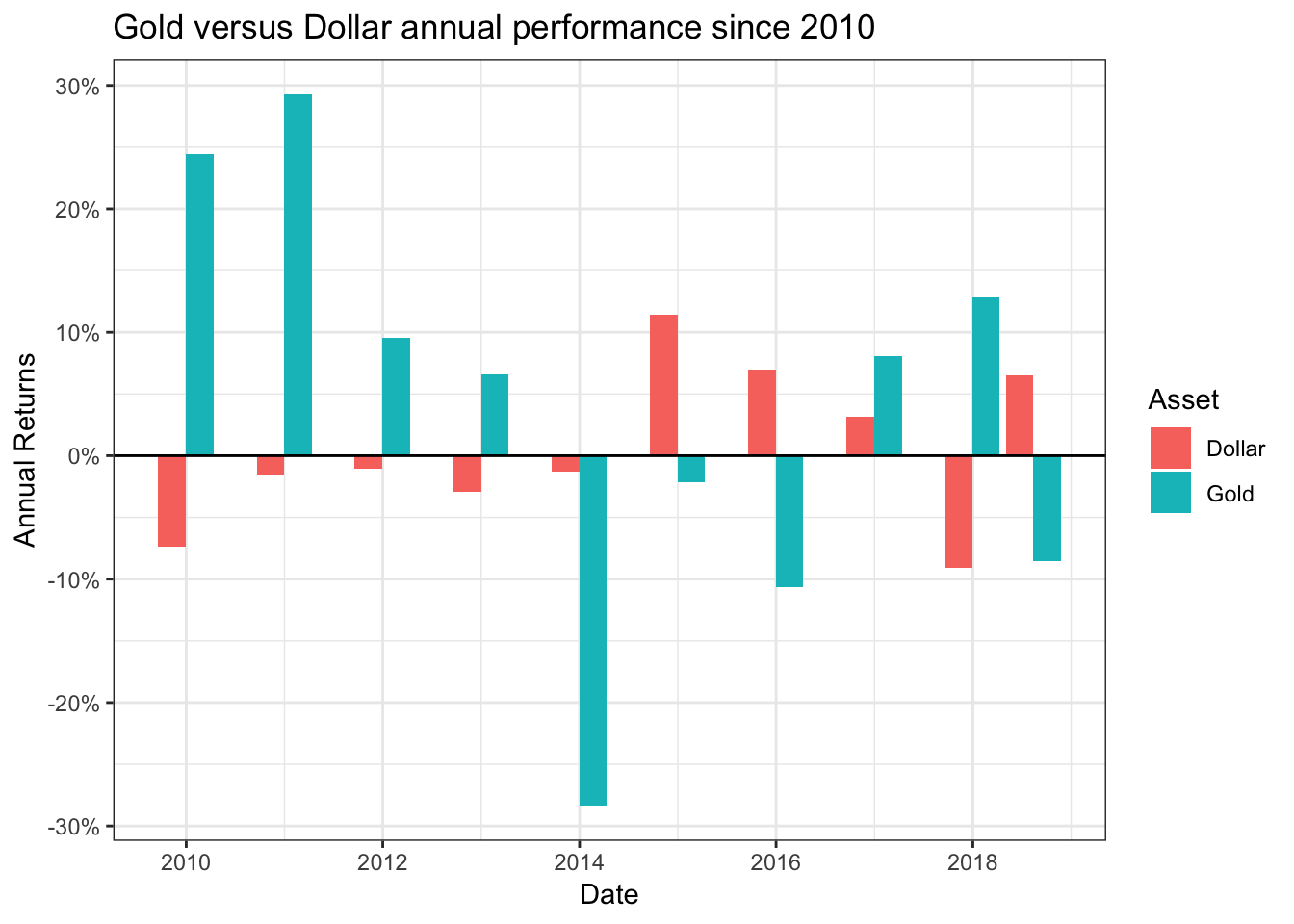

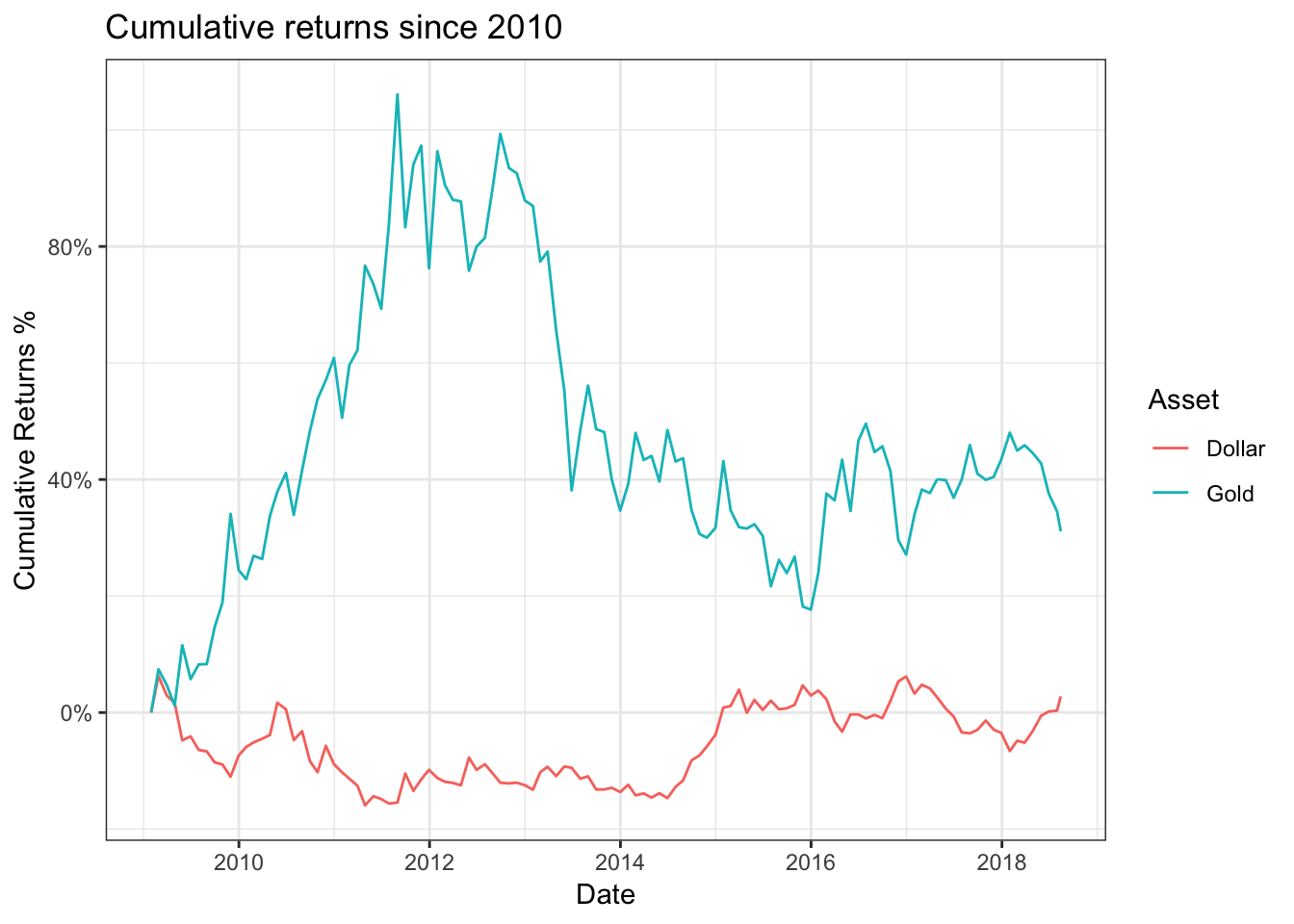

A potential trade idea that we executed today was being long Gold. First lets see how the shiny object has performed since 2010 versus the dollar.

Its clear from the chart that both assets move in opposite directions (most of the time). After the huge run in price in Gold from 2009 t0 2013, it saw a crash in 2014. Since then its been sideways and range bound trading between $1300 to $1200.

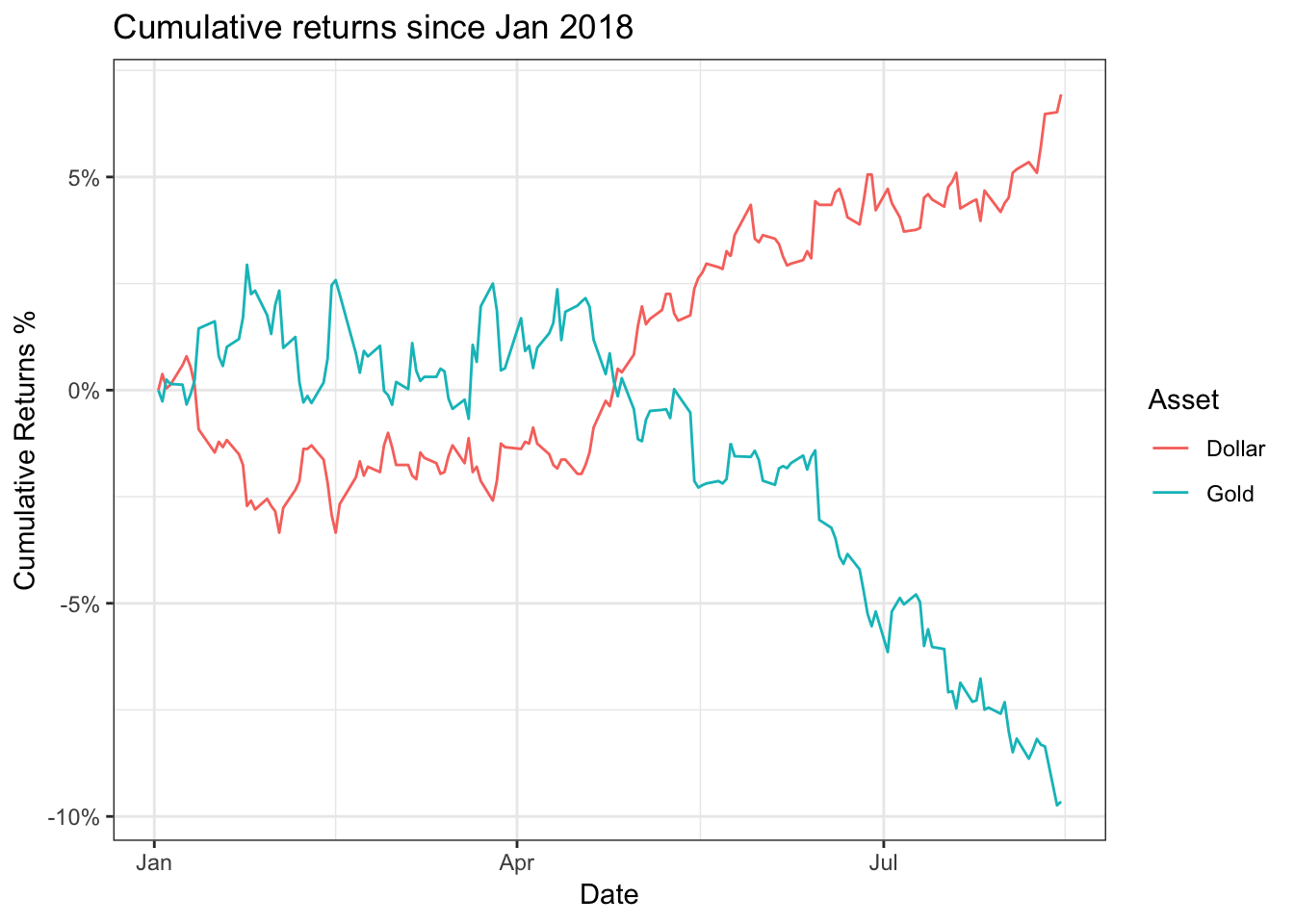

Since April 2018 gold has seen it price go down about 12% and in the same period dollar has rallied about 8%.

This move has largely coincided with President Trump’s escalations of trade war with Europe and China. Since the escalation the dollar has seen a run up in price, which is opposite of what the president may have intented.

We see this as a good trading opportunity to go long the Gold etf via options. Below you can see the current call options chain.

For our trade we are going

- Long GLD 120 strike call options at $0.65

- Short GLD 121 strike call options at $0.51

Our max loss on the trade is $0.14 and max profit is $0.86. This trade will expire in 74 days on October 19,2018. We puposefully wanted to give this trade some time to workout.

We think that GLD has a good chance of bouncing upto $117 in the next few weeks. If that happens we may start seeing some profit on this trade. We will update this post when we make any changes.